Explaining California Intestate Succession With Prince

Every time there is a celebrity death people naturally wonder how their wealth will be distributed. While normally their testamentary documents (will or trust) control the disposition of property, there are rare instances where a celebrity never drafted a testamentary document.

That appears to be the case with Prince. While Prince was reportedly worth $300,000,000 he left no controlling document. As a result, Prince’s fortune will be passed on based on intestate succession.

I first should point out that Prince famously resided in Minnesota so some of my analysis may not be applicable to Minnesota, but most states follow a similar intestate model.

We’ll start our discussion at what intestate succession is. It is the legislature mandated default for the disposition of property. In most occasions the estate will be split between the decedent’s spouse and kids (the amount fluctuates from 50/50 split between the spouse and the children and 1/3rd for the spouse and 2/3rd for the kids depending on the number of kids). But once again, Prince was an exception to the rule, as a result things get a bit more complicated.

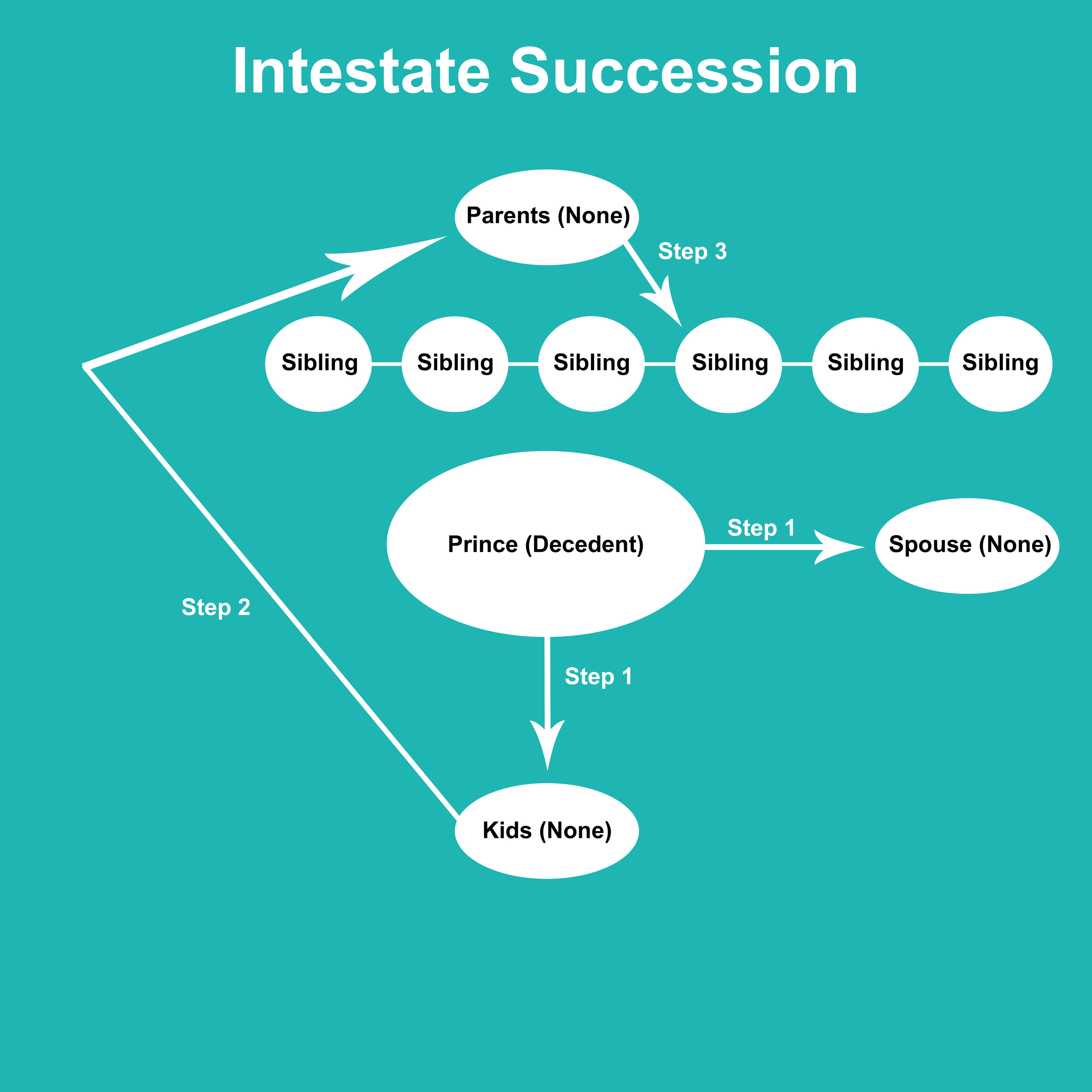

The method the legislature uses to transfer the estate can be described most simply as down, up, and down again.

First you see if the decedent left any children or children of children. In this case, Prince had no children so we must look elsewhere.

If there are no children, then the estate transfers to the decedent’s parents. In this case, Prince’s parents are both dead, so again we must keep looking.

Next you look to see if there are any children of the parents outside of the decedent. In Prince’s case this is where our analysis ends as he has 6 siblings. As a result, his $300,000,000 estate will be split equally between them for a total of $50,000,000 each before taxes and legal fees.

But for the purposes of further explaining intestate succession let’s say Prince was an only child. What would happen then? You essentially repeat the process and go back up and then go down. You look to see if there is a surviving grandparent, if not then the estate gets split among the children of the grandparents, with the amount each person gets depending on how closely they are related to the decedent.

While I hope this post helps clarify intestate succession I know it can be difficult to understand this without a visualization, so I have attached a chart to help.

Prince's Intestate Succession Chart